Beneficial Ownership Information.

Filing Requirements & Reporting.

Beneficial Ownership Information (BOI). Beneficial Ownership Reporting Requirements.

Hire Ntelly, Inc. to assist you in fulfilling your Beneficial Ownership Information (BOI) Filing Requirements with FinCen for your US business entity.

For details on specific provisions, refer to the Beneficial Ownership Information Reporting Rule and Beneficial Ownership Information Access and Safeguards Rule, available at www.fincen.gov/boi

What Are The Beneficial Ownership Information (BOI)Reporting Requirements?

WASHINGTON––Today, FinCEN announced that it will not issue any fines or penalties or take any other enforcement actions against any companies based on any failure to file or update beneficial ownership information (BOI) reports pursuant to the Corporate Transparency Act by the current deadlines. No fines or penalties will be issued, and no enforcement actions will be taken, until a forthcoming interim final rule becomes effective and the new relevant due dates in the interim final rule have passed. This announcement continues Treasury’s commitment to reducing regulatory burden on businesses, as well as prioritizing under the Corporate Transparency Act reporting of BOI for those entities that pose the most significant law enforcement and national security risks.

No later than March 21, 2025, FinCEN intends to issue an interim final rule that extends BOI reporting deadlines, recognizing the need to provide new guidance and clarity as quickly as possible, while ensuring that BOI that is highly useful to important national security, intelligence, and law enforcement activities is reported.

FinCEN also intends to solicit public comment on potential revisions to existing BOI reporting requirements. FinCEN will consider those comments as part of a notice of proposed rulemaking anticipated to be issued later this year to minimize burden on small businesses while ensuring that BOI is highly useful to important national security, intelligence, and law enforcement activities, as well to determine what, if any, modifications to the deadlines referenced here should be considered.

December 27, 2024

In light of a recent federal court order, reporting companies are not currently required to file beneficial ownership information with FinCEN and are not subject to liability if they fail to do so while the order remains in force. However, reporting companies may continue to voluntarily submit beneficial ownership information reports.

The Corporate Transparency Act (CTA) plays a vital role in protecting the U.S. and international financial systems, as well as people across the country, from illicit finance threats like terrorist financing, drug trafficking, and money laundering. The CTA levels the playing field for tens of millions of law-abiding small businesses across the United States and makes it harder for bad actors to exploit loopholes in order to gain an unfair advantage.

On Tuesday, December 3, 2024, in the case of Texas Top Cop Shop, Inc., et al. v. Garland, et al., No. 4:24-cv-00478 (E.D. Tex.), the U.S. District Court for the Eastern District of Texas, Sherman Division, issued an order granting a nationwide preliminary injunction. Texas Top Cop Shop is only one of several cases that have challenged the Corporate Transparency Act (CTA) pending before courts around the country. Several district courts have denied requests to enjoin the CTA, ruling in favor of the Department of the Treasury. The government continues to believe—consistent with the conclusions of the U.S. District Courts for the Eastern District of Virginia and the District of Oregon—that the CTA is constitutional. For that reason, the Department of Justice, on behalf of the Department of the Treasury, filed a Notice of Appeal on December 5, 2024 and separately sought of stay of the injunction pending that appeal.

On December 23, 2024, a panel of the U.S. Court of Appeals for the Fifth Circuit granted a stay of the district court’s preliminary injunction entered in the case of Texas Top Cop Shop, Inc. v. Garland, pending the outcome of the Department of the Treasury’s ongoing appeal of the district court’s order. FinCEN immediately issued an alert notifying the public of this ruling, and recognizing that reporting companies may have needed additional time to comply with beneficial ownership reporting requirements, FinCEN extended reporting deadlines. On December 26, 2024, however, a different panel of the U.S. Court of Appeals for the Fifth Circuit issued an order vacating the Court’s December 23, 2024 order granting a stay of the preliminary injunction. Accordingly, as of December 26, 2024, the injunction issued by the district court in Texas Top Cop Shop, Inc. v. Garland is in effect and reporting companies are not currently required to file beneficial ownership information with FinCEN. Source: Beneficial Ownership Information Reporting | FinCEN.gov

October 29, 2024

FinCEN Provides Beneficial Ownership Information

Reporting Relief to Victims of Hurricane Milton; Certain

Filing Deadlines in Affected Areas Extended Six Months

BOIR UPDATES: Beneficial Ownership Information BOIR Updates

What is the CTA and its Purpose?

The Corporate Transparency Act (CTA) is a powerful regulatory shift aimed at illuminating the true ownership of business entities operating within the U.S. Conceived to prevent illicit financial activities like money laundering and tax evasion, the CTA mandates businesses to reveal their actual or “beneficial” owners to the Financial Crimes Enforcement Network (FinCEN). The intent? To create a system of transparency that bolsters economic integrity while providing essential information for regulatory bodies to monitor the financial landscape.

Is Your Business Ready?

For businesses, readiness means understanding compliance requirements thoroughly and preparing accordingly. Consider whether your company structure necessitates filing—understanding the CTA can help clarify who in the organization qualifies as a beneficial owner and what data FinCEN requires. Businesses should assess not only structural readiness but also their data and document management, ensuring all beneficial ownership details are accurately gathered, recorded, and ready for submission.

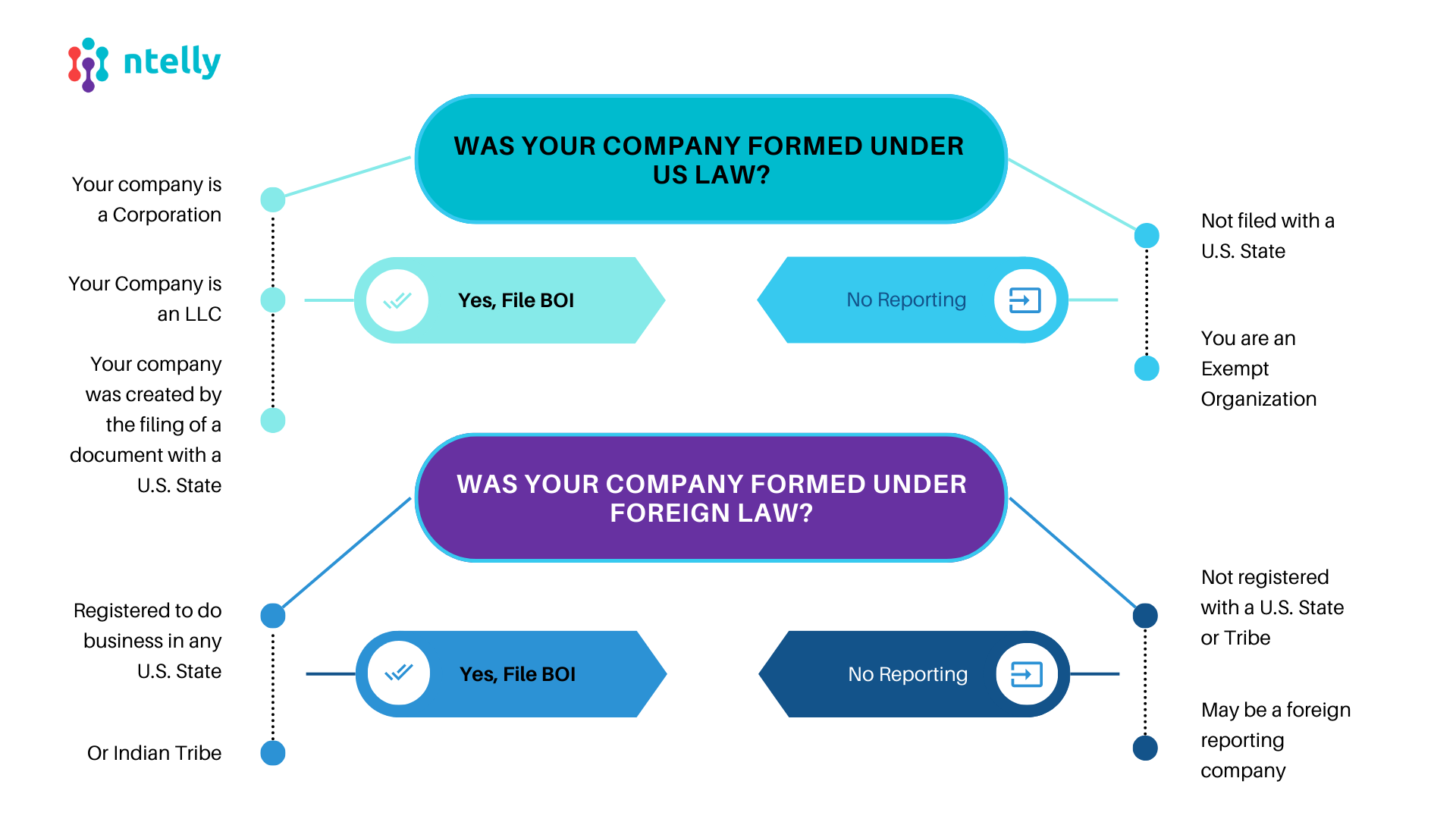

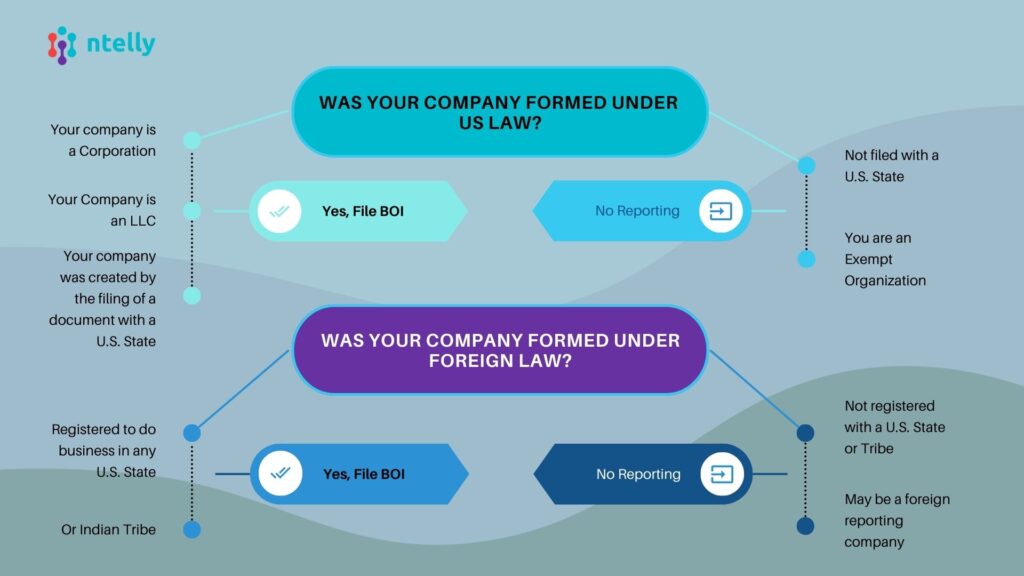

Who Needs to File BOI?

The BOI, or Beneficial Ownership Information report, must be filed by most entities, particularly domestic and foreign corporations, LLCs, and similar entities created or registered to do business in the U.S. Exemptions exist (more on that shortly), but the majority of smaller to mid-sized businesses will need to report. The core idea is to identify the individuals who truly control or benefit from the entity’s operations.

Is Your Business Ready?

For businesses, readiness means understanding compliance requirements thoroughly and preparing accordingly. Consider whether your company structure necessitates filing—understanding the CTA can help clarify who in the organization qualifies as a beneficial owner and what data FinCEN requires. Businesses should assess not only structural readiness but also their data and document management, ensuring all beneficial ownership details are accurately gathered, recorded, and ready for submission.

What Information Needs to Be Reported?

The CTA’s requirements are precise: businesses must report essential details on each beneficial owner, including full legal name, date of birth, residential address, and an identification number like a driver’s license or passport. This information creates a clear, identifiable record of the individuals behind each entity, aiding regulatory transparency and accountability.

Are Some Companies Exempt?

What Are the Deadlines for Filing?

For newly formed entities, the clock starts immediately: they must file their BOI within 30 days of registration. Existing businesses, on the other hand, have a compliance window until January 1, 2025. Meeting these deadlines is paramount, as non-compliance incurs penalties, underscoring the need for proactive preparation to ensure timely submission.

What Are the Fines for Not Filing?

Failure to file or inaccuracies in filing are met with stiff penalties. Businesses face fines up to $500 per day of non-compliance, alongside potential criminal charges for more serious or intentional violations. These fines underscore the importance of ensuring that your BOI report is both timely and accurate.

Testimonials from our happy clients.

Our current customers get the best price.

Initial Reporting

Current Clients From

-

Electronically File BOI

-

Obtain FinCen BOIR ID

-

One-Time Transaction

Ongoing

Current Clients From

-

Annual Charge

-

Unlimited Changes

-

Combine w/Registered Agent for Max Savings

For businesses today, complying with the Corporate Transparency Act isn’t just a regulatory checkbox—it’s a proactive step toward protecting your company's reputation and aligning with a future where transparency is non-negotiable. Companies that take ownership of their compliance strategy not only mitigate risks of fines but also foster trust in an environment that increasingly values accountability. In a world where credibility matters, aligning with the CTA’s requirements is both a legal obligation and a strategic advantage.

Ion Tiu, Pro Advisor

Are Some Companies Exempt? Which Ones?

Indeed, the CTA does provide exemptions, creating a sensible approach that targets transparency where it’s most needed. Among the 23 exempt categories are publicly traded companies, financial institutions, and certain large-scale operations meeting specific revenue and employee thresholds. Nonprofits and governmental entities are also generally exempt. However, even exempt entities should verify their status, as nuances may impact their compliance requirements.

Beneficial Ownership Information Report.

Are you looking to hire Ntelly, Inc. to file your BOI report?

Request BOI Reporting

Partner with a company you can trust.

1

Structure

We help you decide on the optimal corporate structure.

2

Tax Savings

We calculate your tax savings and confirm your corporate structure will deliver the best results.

3

File LLC

We organize and form/file your LLC with the state.

4

Books

We set up your books. If you chose to use our software, there are no additional costs. You can also bring your own subscription.

5

Taxes

We file your taxes.

Top companies use Ntelly

Incorporate To Drive Growth.

States Considered Advantageous for Business Registration.

Are all states created equally?

Ntelly Inc can assist you in choosing the right home-state registration to provide various legal and tax advantages.

Here are some tips and considerations for registering in different states, along with highlighting states that are often considered more advantageous for business formation:

- Delaware: Known for its business-friendly legal environment, Delaware is a popular choice for LLCs and corporations, especially large ones. It offers strong privacy protections and doesn’t require shareholders, directors, or officers to be residents. Delaware also has a well-established Court of Chancery that handles business disputes.

- Nevada: Nevada offers no state income taxes and doesn’t share information with the Internal Revenue Service. It also provides strong protection against company owner liability.

- Wyoming: Wyoming is attractive due to its low fees, privacy (no state taxes on corporate income), and does not require member or manager names on a public database.

- South Dakota and Florida: Both are favored for their absence of individual income tax, which might benefit pass-through entities like S Corps or LLCs treated as partnerships.

Our services cost one tenth (1/10) of a US based full-time accountant.*