Advanced Tax Planning

To Supercharge Your Financial Future.

Tax Planning Can Be Your Next #1 Wealth Building Tool.

Discover cutting-edge Tax Planning strategies and unleash the power of Roth IRA, 401K, tax loss harvesting, succession planning, and cost segregation. Whether you’re an individual, a high net worth individual, a business owner, or nearing retirement, maximize every opportunity with expert advice on grantor trusts, estate tactics, and more.

For details on specific provisions, refer to the IRS website at www.irs.gov

Are You Ready To Take YourWealth TrajectoryTo A Whole New Level?

December 27, 2024

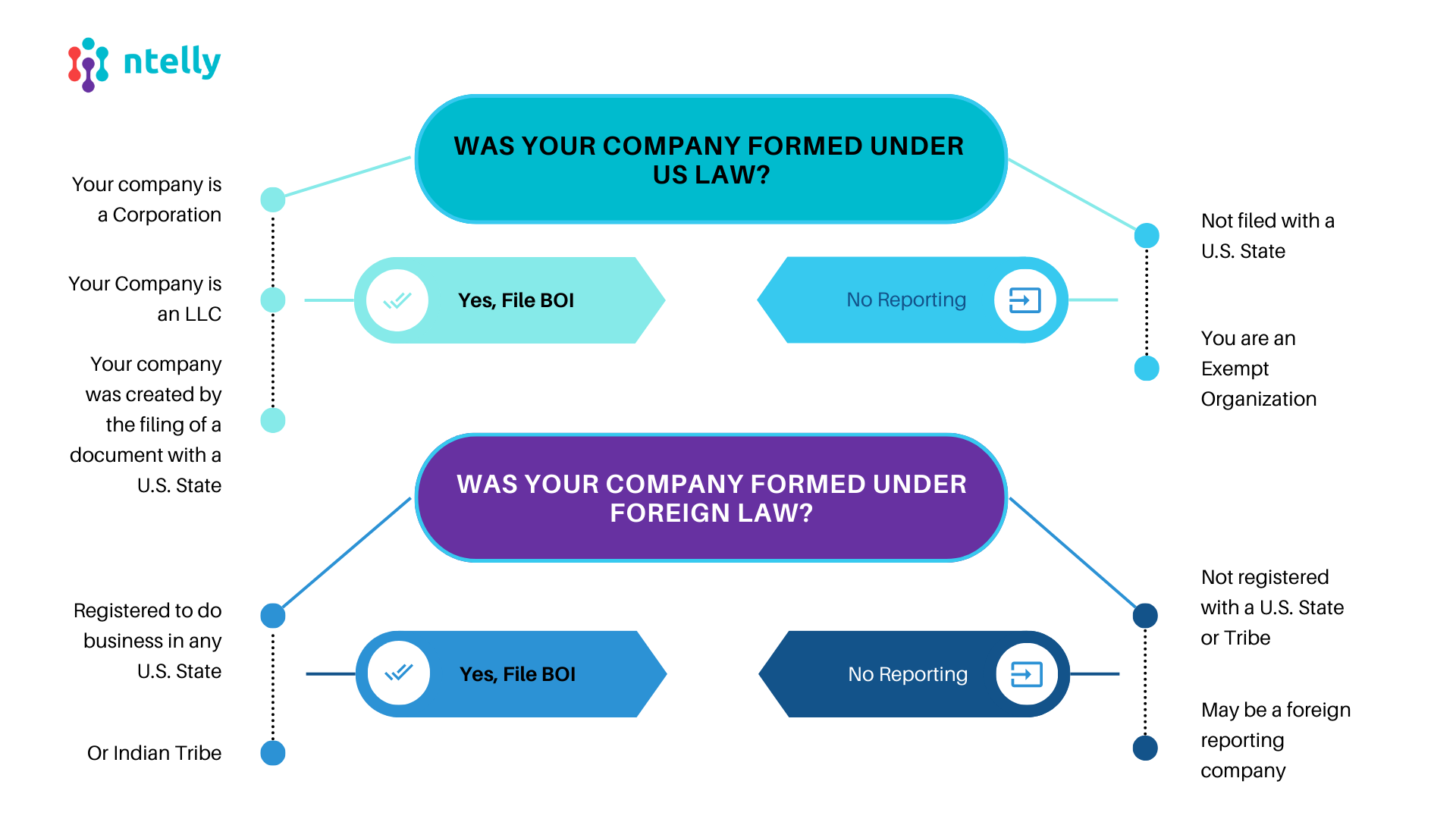

In light of a recent federal court order, reporting companies are not currently required to file beneficial ownership information with FinCEN and are not subject to liability if they fail to do so while the order remains in force. However, reporting companies may continue to voluntarily submit beneficial ownership information reports.

The Corporate Transparency Act (CTA) plays a vital role in protecting the U.S. and international financial systems, as well as people across the country, from illicit finance threats like terrorist financing, drug trafficking, and money laundering. The CTA levels the playing field for tens of millions of law-abiding small businesses across the United States and makes it harder for bad actors to exploit loopholes in order to gain an unfair advantage.

On Tuesday, December 3, 2024, in the case of Texas Top Cop Shop, Inc., et al. v. Garland, et al., No. 4:24-cv-00478 (E.D. Tex.), the U.S. District Court for the Eastern District of Texas, Sherman Division, issued an order granting a nationwide preliminary injunction. Texas Top Cop Shop is only one of several cases that have challenged the Corporate Transparency Act (CTA) pending before courts around the country. Several district courts have denied requests to enjoin the CTA, ruling in favor of the Department of the Treasury. The government continues to believe—consistent with the conclusions of the U.S. District Courts for the Eastern District of Virginia and the District of Oregon—that the CTA is constitutional. For that reason, the Department of Justice, on behalf of the Department of the Treasury, filed a Notice of Appeal on December 5, 2024 and separately sought of stay of the injunction pending that appeal.

On December 23, 2024, a panel of the U.S. Court of Appeals for the Fifth Circuit granted a stay of the district court’s preliminary injunction entered in the case of Texas Top Cop Shop, Inc. v. Garland, pending the outcome of the Department of the Treasury’s ongoing appeal of the district court’s order. FinCEN immediately issued an alert notifying the public of this ruling, and recognizing that reporting companies may have needed additional time to comply with beneficial ownership reporting requirements, FinCEN extended reporting deadlines. On December 26, 2024, however, a different panel of the U.S. Court of Appeals for the Fifth Circuit issued an order vacating the Court’s December 23, 2024 order granting a stay of the preliminary injunction. Accordingly, as of December 26, 2024, the injunction issued by the district court in Texas Top Cop Shop, Inc. v. Garland is in effect and reporting companies are not currently required to file beneficial ownership information with FinCEN. Source: Beneficial Ownership Information Reporting | FinCEN.gov

October 29, 2024

FinCEN Provides Beneficial Ownership Information

Reporting Relief to Victims of Hurricane Milton; Certain

Filing Deadlines in Affected Areas Extended Six Months

BOIR UPDATES: Beneficial Ownership Information BOIR Updates

Revolutionize Your Finances Through Tax Planning.

Are you ready to take your wealth trajectory to a whole new level? In today’s fast-paced world, Tax Planning can feel exhilarating yet complex. If you crave absolute efficiency, fewer tax surprises, and strategic wealth acceleration, you’ve come to the right place. We’ve developed this all-encompassing Tax Planning guide to energize your approach and unlock all the hidden opportunities that lead to better financial outcomes. Hang on as we reveal practical tips, crucial facts, and four critical areas—Individual Tax Planning, High Net Worth Tax Planning, Business Tax Planning, and Retirement Income Planning—that will help you master the art and science of true financial optimization.

How Can You Use This Resource?

Within this resource, you’ll discover how the power of Tax Planning can make your Roth IRA contributions more valuable, optimize your 401K strategies, harness the benefits of tax loss harvesting, and leverage cost segregation for business assets. You’ll also explore forward-thinking techniques like setting up a grantor trust, tailoring specialized succession planning solutions, and addressing the needs of the high net worth individual. Get ready to expand your portfolio, reduce liabilities, and steer your financial future toward unstoppable growth.

The Power of Individual Tax Planning (Accelerate Your Personal Savings).

Why Individual Tax Planning Is the Ultimate Life Hack

When you think about Tax Planning at the personal level, picture it as upgrading the internal software of your financial life. Tax Planning for individuals ensures that every financial decision—large or small—reduces tax costs, boosts your disposable income, and aligns with your broader life goals. By utilizing strategies such as solid Roth IRA contributions or annual tax loss harvesting, you secure a smoother road ahead.

Essential Services for Individual Tax Planning.

Our CPA firm provides a comprehensive suite of services that fortify your personal Tax Planning. We watch your tax brackets, uncover opportunities for tax loss harvesting, and walk you through maximizing Roth IRA or 401K contributions. Each plan is customized to your goals, giving you the freedom to invest confidently in your aspirations.

Our approach to personal Tax Planning remains flexible and advanced, adapting as your life circumstances change. Whether it’s a career shift, a windfall, or a setback, we keep tabs on potential tax pitfalls and tweak your strategy accordingly. The objective is to transform every tax dollar saved into an engine for growth. Through meticulous forecasting, ongoing collaboration, and an unwavering focus on your future, we empower you to make financial decisions backed by clarity and precision.

-

Accelerating Savings with Roth IRA Contributions

-

Implementing Tax Loss Harvesting for Personal Portfolios

-

Leveraging the 401K for Individual Tax Efficiency

A Roth IRA is a potent tool in Tax Planning. Contributions involve post-tax dollars, which means you may enjoy tax-free growth and withdrawals in retirement if all requirements are met. Here’s why that matters:

- Future-Proofing: Paying taxes on your contributions now can potentially shield you from higher rates later.

- Liquidity: Certain exceptions may allow you to withdraw Roth contributions penalty-free if needed.

Incorporating a Roth IRA into your individual Tax Planning strategy offers more predictability over your long-term tax situation. This is especially beneficial if you anticipate your income—and tax bracket—rising over time.

During market downturns, many investors react with alarm. Meanwhile, savvy Tax Planning taps into these dips via tax loss harvesting—selling securities at a loss to offset current or future capital gains in a taxable brokerage account.

By strategically capturing these losses, you can lower your total capital gains taxes, effectively freeing more funds for reinvestment. Tax loss harvesting can be transformative for personal wealth-building, placing you in greater control of your overall tax liability. Be mindful of the IRS wash-sale rules to maintain compliance while enhancing your portfolio’s efficiency.

While 401K plans are typically offered by employers, they present significant potential for individual Tax Planning. Contributing to a 401K on a pre-tax basis effectively reduces your taxable income each year you participate. Some employers also offer matching, which can substantially boost your retirement nest egg.

Before finalizing your contribution rate, consider your short-term cash needs and any anticipated salary increases. Contributing too little may sacrifice employer matching; contributing too much could leave you short on daily expenses. By carefully calibrating contributions to your 401K, you set yourself on a path toward both retirement security and optimal tax outcomes.

High Net Worth Tax Planning (Boost Your Luxury Lifestyle with Smart Strategies).

Understanding the High Net Worth Individual Perspective.

A high net worth individual manages tax challenges far more intricate than a typical single or joint filer. Think multiple businesses, expansive real estate, or international investments. Tax Planning for affluent investors is about minimizing exposure while maximizing the benefits of advanced strategies like tax loss harvesting or leveraging a grantor trust.

High levels of wealth introduce added complexity, from estate tax concerns to philanthropic objectives. Our approach pinpoints sophisticated methods—such as carefully timed asset sales and specialized trust setups—to help you capitalize on tax incentives. By focusing on opportunities like Roth IRA conversions during lower-income periods or offsetting significant capital gains with losses, we shield more of your assets from heavy taxation. Each tactic is designed to preserve capital for future endeavors while staying fully compliant.

The Grantor Trust Advantage.

A pivotal element in High Net Worth Tax Planning is the grantor trust. With this arrangement, you, as the trust’s grantor, retain specific controls over trust assets. Although trust earnings might flow through your personal tax return, the trust itself can grow without constantly depleting principal to cover taxes internally.

Why would a high net worth individual prefer this? Because covering the trust’s taxes personally allows the trust assets to grow in a more uninterrupted manner. When combined with other wealth-preserving strategies, a grantor trust can be a fundamental building block in your personalized Tax Planning plan.

The Grantor Trust Advantage.

Are You The Strategic Roth IRA Conversions Type?

High earners—especially a high net worth individual—can also benefit from converting pre-tax retirement funds into a Roth IRA. By paying taxes on the conversion now, you potentially lock in a lower rate and relieve future distributions from tax obligations. The timing of conversions is crucial, often aligning with years of reduced earnings or significant deductions.

In some instances, you might pair a Roth IRA conversion with tax loss harvesting to offset the income from the conversion. These types of cohesive strategies can boost long-term savings dramatically. Our firm helps calculate each variable, delivering a clear picture of whether a Roth IRA conversion aligns with your overarching Tax Planning blueprint.

Succession Planning for Generational Wealth.

Succession planning ensures your wealth doesn’t unravel when it transitions to children, grandchildren, business associates, or charitable entities. From a Tax Planning angle, the right structure might involve family limited partnerships, strategic gifting to reduce taxable estates, or locking in valuations when asset prices are favorable.

A robust succession planning arrangement works in tandem with methods such as cost segregation for commercial properties (discussed later), as well as a grantor trust for high-growth investments. This multi-layer strategy brings estate tax benefits without compromising control over assets. Whether your goal is to ensure familial stability or support philanthropic causes, timely succession planning lays the groundwork for an enduring legacy. Our firm offers systematic guidance in tailoring your approach so it safeguards your intentions and optimizes tax efficiency, even across generations.

Testimonials from our happy clients.

Our current customers get the best price.

Individuals

Current Clients From

-

Retirement Plans

-

Asset Sale

-

W2 & Social Security

Business

Current Clients From

-

Succession Planning for Business Continuity

-

Leveraging 401K and Retirement Plans

-

Uncover Overlooked Opportunities

We craft specialized Tax Planning frameworks for each high net worth individual. By coordinating succession planning, philanthropic tools, and trust-based solutions like the grantor trust, alongside proven tactics such as tax loss harvesting or Roth IRA conversions, we work to preserve your wealth and streamline your tax burden.

Ion Tiu, Pro Advisor

Our Solutions for the High Net Worth Individual.

We analyze your current holdings, future earning potential, and business structures. This includes collaborative efforts with estate attorneys, private bankers, and other advisors. Where overseas interests exist, we tap into international tax treaties and compliance mechanisms to mitigate cross-border taxation. Our mission is to provide advanced Tax Planning that caters to your lifestyle, long-term family goals, and personal values. Through thorough communication and measurable benchmarks, we equip you with the data and guidance to protect, expand, and refine your financial empire for decades to come.

Turbocharge Your Future with Our All-Inclusive Tax Planning Services

Request Tax Planning

Business Tax Planning - Outmaneuver the Competition with Futuristic Moves.

Why Business Tax Planning Is a Game Changer.

Tax Planning for businesses supercharges your profitability. Whether you run a solo operation or a multinational, structuring deductions, credits, and depreciation schedules can drastically impact your bottom line. Strategies like cost segregation can uncover larger short-term deductions, fueling reinvestment in product innovation or talent acquisition.

Devising a solid Tax Planning approach gives you a competitive edge in volatile markets. For instance, re-categorizing components of a building via cost segregation may unearth thousands—or millions—of dollars in accelerated deductions. Well-orchestrated succession planning can ensure your company remains resilient amid leadership transitions. Regardless of sector or scale, proactive Tax Planning keeps you in command of your financial course, allowing you to focus on growth, market penetration, and brand development with minimal fiscal hurdles.

Cost Segregation: A Catalyst for Savings.

In Business Tax Planning, cost segregation stands out as a powerful method to shift certain building or property components into faster depreciation classes. Doing so speeds up deductions, often generating immediate tax relief and bolstering cash flow.

A detailed cost segregation report might classify specialized lighting, landscaping, or carpeting under shorter asset lives, which can greatly enhance your annual deductions. If you operate in real estate, manufacturing, or hospitality, cost segregation can inject significant liquidity back into your operations early on. Our team conducts a thorough review of each commercial property, ensuring you capitalize on every possible savings avenue.

-

Leveraging 401K and Retirement Plans for Small Businesses

-

Succession Planning for Business Continuity

-

Our Business Tax Planning Services

Talk of 401K plans typically revolves around employees, but small to mid-sized businesses can leverage them to enhance recruitment and retention while benefiting from substantial tax deductions. Employer-matched 401K contributions can reduce taxable profits, create loyalty among employees, and foster a beneficial workplace culture.

The key is selecting the right plan—be it a SIMPLE IRA, 401K, or another structure—based on factors like company size, workforce demographics, and anticipated growth. Our CPA firm evaluates all angles, integrating potential succession planning moves to ensure leadership transitions are smooth. We also highlight how to incorporate tax loss harvesting for your corporate-held brokerage or retirement accounts. This multi-dimensional strategy aims to protect and fortify your business in every phase of its evolution.

Strategic succession planning guarantees seamless operations even if top executives leave or the original founder steps away. From a Tax Planning standpoint, certain contractual agreements or valuation adjustments can reduce estate or gift tax implications.

Establishing a forward-looking succession planning structure includes grooming future leadership, outlining equity transfers, and clarifying policies for buy-sell agreements. By coordinating with trust and estate professionals, you can proactively minimize tax exposure for both outgoing and incoming stakeholders. A strong blueprint helps avert power vacuums, maintains client trust, and ensures no one is caught off guard if health issues, retirement, or relocations occur. Our firm stands ready to map out a clear plan, balancing business continuity with the most effective Tax Planning approach.

We assist enterprises in tax loss harvesting for corporate investments, conduct specialized cost segregation studies for real estate, oversee 401K setups, and integrate forward-thinking succession planning solutions. Through regular reviews, we keep your business’s Tax Planning strategy aligned with evolving market conditions.

Whether you’re aiming to diversify product lines or break into international markets, our expertise uncovers overlooked opportunities and ensures full compliance. Each recommendation is powered by data analytics, industry best practices, and a drive for innovation. We serve as your strategic partner, not just your accountant, helping you execute Tax Planning with precision and creativity. Our goal is to empower your business so that you’re positioned for profitability, resilience, and steady expansion.

Partner with a company you can trust.

1

Structure

We help you decide on the optimal corporate structure.

2

Tax Savings

We calculate your tax savings and confirm your corporate structure will deliver the best results.

3

File LLC

We organize and form/file your LLC with the state.

4

Books

We set up your books. If you chose to use our software, there are no additional costs. You can also bring your own subscription.

5

Taxes

We file your taxes.

Retirement Income Planning -Ensure a Smooth Cruise Through Your Golden Years.

The New Paradigm of Retirement Income.

Retirement is no longer about receiving a single pension check or Social Security. In modern Tax Planning, you can combine Roth IRA, 401K funds, annuities, and other investments to maintain a consistent flow of income. A well-structured plan times withdrawals to optimize brackets and prevent expensive mistakes.

Our method to Retirement Income Planning is entirely personalized. A careful review might show a need for Roth IRA conversions in lower-income years, or for tax loss harvesting to offset gains from selling appreciated stocks. By mixing pre-tax retirement accounts with after-tax accounts, you can maneuver effectively around unexpected costs or life changes. The upshot is greater control, minimal tax shocks, and the peace of mind that each piece of your retirement puzzle fits neatly in place.

Roth IRA vs. 401K: What’s Right for You?

The debate over Roth IRA or 401K doesn’t need to be an either-or choice. Many people, especially those with employer contributions, split their funds between both. A 401K can offer large tax-deferred contributions and a match, while a Roth IRA provides tax-free growth on qualified distributions.

If your employer doesn’t match, or if you’re maximizing your 401K and still have extra funds to save, funneling more into a Roth IRA can balance out your tax positions in retirement. Diversification across account types can prove invaluable when you begin drawing income. Our CPAs measure potential outcomes based on your projected retirement date, current income, and any expected changes in tax legislation. This holistic perspective helps you maintain both flexibility and security.

The Art of Withdrawing Funds and Minimizing Taxes.

A common error in retirement is taking withdrawals from all accounts at the same ratio. More efficient Tax Planning might see you drawing from a Roth IRA one year, a 401K the next, or a taxable account when capital gains can be offset by tax loss harvesting.

Required Minimum Distributions (RMDs) from IRAs and 401K plans often complicate matters, pushing you into higher tax brackets unexpectedly. Our comprehensive approach calculates all possibilities, ensuring you withdraw funds optimally. By strategically scheduling distributions, you can minimize annual tax hits while supporting your lifestyle. We also keep your estate goals in view, making sure your assets are positioned to benefit heirs as smoothly and cost-efficiently as possible.

-

Integrating Succession Planning into Retirement

-

Our Retirement Income Planning Services

Succession planning isn’t reserved solely for business owners. Effective Tax Planning for retirees also considers how assets pass to beneficiaries, using beneficiary designations on Roth IRA, 401K, or annuities. If you do own a business or substantial real estate, merging personal estate considerations with succession planning ensures an orderly handoff.

Even for those who aren’t necessarily a high net worth individual, estate complexities can arise if not carefully managed. A grantor trust might safeguard large assets for your family, while directives ensure guardianship arrangements and healthcare instructions are ready if needed. Our advisors help unify retirement projections with estate logistics, setting the stage for a comfortable future. It’s an all-in-one approach that relieves both you and your loved ones from unnecessary burdens down the line.

Our CPA team offers comprehensive Tax Planning services for the retiree or soon-to-be retiree. We review your retirement accounts, advise on Roth IRA conversions, structure your 401K contributions, and use tax loss harvesting where beneficial. The result is a multi-layer plan finely balanced between growth, stability, and tax efficiency.

Staying current with changing tax laws is a big part of this, so we track legislative shifts, reevaluate your plan, and suggest timely adjustments. If your situation calls for partial Roth IRA conversions or specific withdrawal timing, we guide you through the process. The outcome is a retirement fund that sustains your goals, whether that means global travel, supporting your grandchildren’s education, or simply enjoying a life free from tax anxiety.

Turbocharge Your Future with Our All-Inclusive Tax Planning Services.

Comprehensive Solutions for Every Stage of Life

Our CPA firm delivers a suite of Tax Planning solutions—spanning Individual Tax Planning, High Net Worth Tax Planning, Business Tax Planning, and Retirement Income Planning. We excel at integrating advanced approaches like tax loss harvesting, maximizing Roth IRA and 401K strategies, and deploying cost segregation for real estate.

For the high net worth individual, we zero in on succession planning techniques that can include a grantor trust to protect appreciating assets and manage estate taxes effectively. Business owners benefit from the synergy of tax-saving methods paired with future leadership continuity plans. Everything we do is backed by real-time research, in-depth projections, and a commitment to making your tax obligations as efficient as possible. The outcome? Heightened control over your financial destiny, and the peace of mind that every tax dollar is working hard for you.

Why Partner with Us for Tax Planning

At our core, we believe Tax Planning transcends mere annual deductions or potential refunds. It’s a robust framework for your entire future. We strive to keep paragraphs concise, communication transparent, and outcomes extraordinary, reflecting a progressive mindset.

Our expertise covers how to harmonize Roth IRA strategies, tax loss harvesting, cost segregation, and succession planning into a single, cohesive system for financial success. Whether you’re a high net worth individual exploring complex trust structures, a startup founder planning for growth, or a retiree managing RMDs and estate details, we simplify each step. Let us enhance your capacity to preserve capital, reduce obligations, and move confidently in a dynamic financial landscape.

Taking the Next Step in Your Tax Planning Journey

Ready to embrace a progressive approach to Tax Planning? Our discovery session delves into your financial background, risk tolerance, and long-term aspirations. We deliver data-driven advice that has the power to alter your financial course in exciting, sustainable ways.

Our priority is ensuring your Tax Planning remains nimble, shifting as you encounter milestones like career changes, business deals, or relocations. We also continuously evaluate your potential for tax loss harvesting, cost segregation, or a well-structured grantor trust, making certain no opportunity goes unnoticed. Let us guide your finances with precision, dedication, and insight, so you can focus on thriving in every new venture.

Top companies use Ntelly

Our services cost one tenth (1/10) of a US based full-time accountant.*