Everything You Need to Know About Becoming a Women-Owned Business

February 1, 2023

No Comments

Read More »

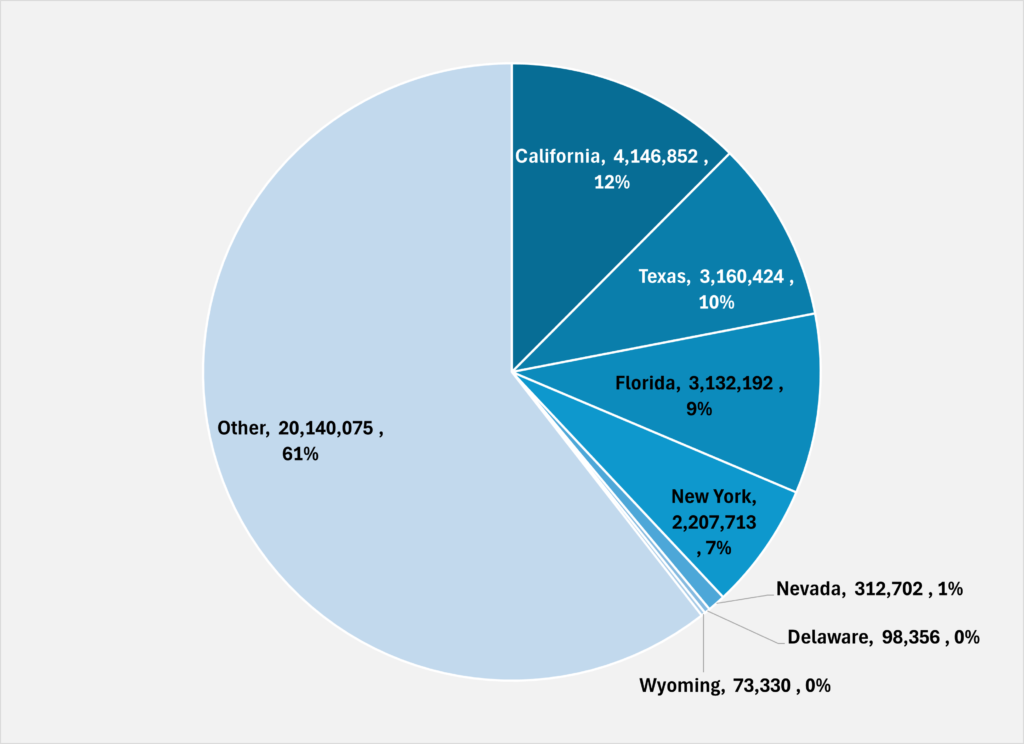

At Ntelly, Inc. we explore the strategic advantages of incorporating your business in the USA with our latest guide. Learn about the legal protections, tax benefits, and increased credibility that come with incorporation. We also compare the pros and cons of incorporating in popular states like Delaware, Nevada, and Wyoming, helping you decide the best state for your business needs.

Incorporation services in the USA refer to the assistance provided by various companies or legal professionals to help businesses legally establish themselves as corporations. Incorporating a business can provide several benefits, such as limited liability protection for owners, potential tax advantages, and enhanced credibility.

Here’s a general overview of what the incorporation process involves:

When registering an LLC or corporation, choosing the right state can provide various legal and tax advantages. Here are some tips and considerations for registering in different states, along with highlighting states that are often considered more advantageous for business formation:

Understand State Laws and Requirements: Each state has its own set of rules regarding business operations, compliance, reporting, and taxes. Before deciding where to register, research the specific requirements and how they align with your business needs.

Consider the Tax Implications: Some states offer significant tax advantages, such as no state income tax, which can be beneficial depending on your business structure and revenue model.

Assess Filing Fees and Annual Fees: Initial filing fees and ongoing annual fees can vary widely from state to state. Consider these costs as part of your overall budget.

Think About Physical Presence: Some states require that you have a physical presence or a registered agent within the state. This can influence your decision if you do not reside in or near the state where you are considering registration.

Legal Protections: Look into the legal protections offered to business owners and operators in the state. Some states have more favorable laws protecting privacy and reducing liability.

Ease of Doing Business: Some states are known for their efficient bureaucratic processes and business-friendly government policies, which can make starting and maintaining a business easier.

Source: The Pie Chart was produced by Ntelly, Inc. using data from The United States Census Bureau website.

Foreign Qualification: If you decide to operate in states other than where your LLC or corporation is registered, you’ll need to register as a foreign entity in those states. This involves additional fees and paperwork.

Choosing to incorporate a business rather than operating as a sole proprietorship involves several important considerations, each with potential benefits depending on your business needs, financial goals, and risk tolerance. Here are some key reasons why you might choose to incorporate:

Liability Protection

Tax Benefits

Credibility and Perception

Capital Acquisition

Continuity and Transferability

Employee Attraction and Retention

Privacy

Each business scenario is unique, so the decision to incorporate should be made after carefully considering the specific circumstances of your business. Call today to speak with our experts to understand the implications and optimally incorporate your business.

I love to write about the pieces of the corporate profits' puzzle. Dashboards and automation are my next best skills. What will you write about?

© 2024 Ntelly, Inc. All rights reserved

1 thought on “Unlocking the Benefits of Incorporating Your Business in the USA”

We are looking to incorporate in Delaware but have been turned off by the recent events with the courts as seen in Tesla and some other high-profile cases. What is your position on DE as a home base? Thanks

Comments are closed.